Financial Advisor Certifications Fundamentals Explained

Wiki Article

The 6-Minute Rule for Financial Advisor

Table of ContentsFacts About Financial Advisor Ratings RevealedUnknown Facts About Financial AdvisorFinancial Advisor Job Description Things To Know Before You BuyWhat Does Financial Advisor Magazine Do?4 Simple Techniques For Financial Advisor Job Description

You should also think about just how much cash you have. If you're trying to find an expert to handle your cash or to assist you invest, you will require to fulfill the expert's minimal account needs. Minimums differ from expert to advisor. Some might work with you if you have just a couple of thousand dollars or less.

You'll then have the capacity to interview your suits to locate the best fit for you.

The smart Trick of Financial Advisor License That Nobody is Talking About

Prior to meeting with a consultant, it's a great idea to think of what sort of expert you require. Beginning by thinking about your financial circumstance as well as objectives. Advisors occasionally specialize to come to be specialists in one or 2 elements of individual money, such as tax obligations or estate preparation. So if you're looking for specific recommendations or solutions, consider what kind of monetary advisor is a specialist in that area.

Which one should you deal with? We find that, mostly, individuals looking for economic advice know to look for a monetary advisor that has high degrees of integrity and who wishes to do what remains in their clients' best rate of interest at all times. It appears that fewer individuals pay focus to the positioning of their financial advisor candidates.

Some Known Details About Financial Advisor Jobs

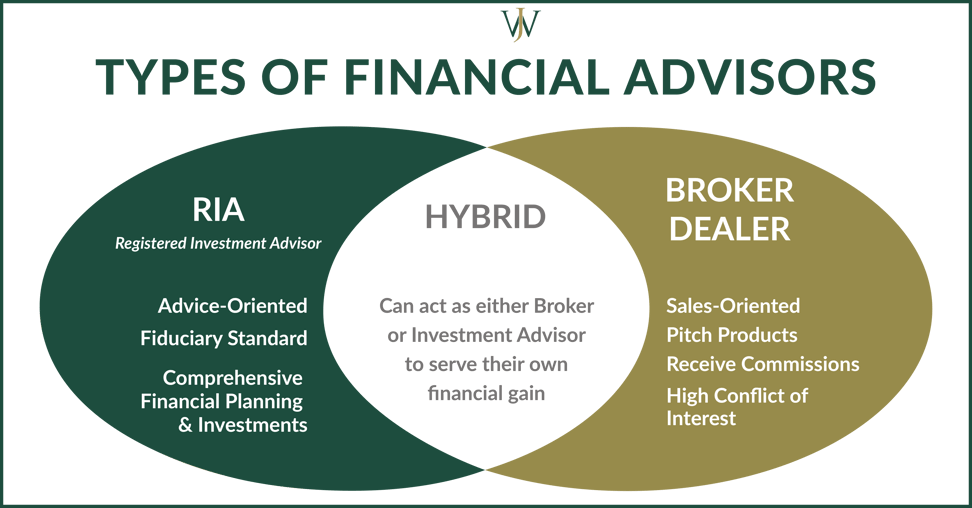

Here's a check out four various types of experts you are most likely to experience and also how they stack up versus each other in some crucial locations. Armed with this information, you must be able to much better assess which type is ideal fit for you based on elements such as your goals, the intricacy of your economic situation as well as your total assets.Allow's take a look at each team. 1. Financial investment expert. A great way to believe regarding the wide range monitoring pecking order is that it's progressive, or additive. We start with the base. Investment experts are excellent monetary experts who do an excellent job managing moneybut that's all they do. While investment consultants offer a solitary solutionmoney managementthat one remedy can have numerous variants (from securities to investments in private business, realty, artwork etc).

, one need to first get the needed education and learning by taking economic consultant courses. Financial advisors have to have at the very least a bachelor's degree, as well as in some cases a master's is recommended.

The Best Strategy To Use For Financial Advisor Ratings

Financial consultants will require this foundation when they are advising clients on decreasing their risks and saving money. Another area of research study concentrates on financial investment preparation. In this training course, pupils find out exactly how the stock exchange jobs together with various other financial investment approaches. When functioning as a monetary expert, expertise of financial investment preparation might verify vital when trying to create investment methods for clients., such as changing a headlight or an air filter, but take the auto to a technician for huge jobs. When it comes to your financial resources, though, it can be trickier to figure out which tasks are DIY (financial advisor ratings).

There are all kinds of monetary pros out there, with lots of various image source titles accounting professionals, financiers, money supervisors. It's not constantly clear what they do, or what kind of problems they're furnished to manage. If you're feeling out of your depth economically, your primary step should be to learn who all these various economic professionals are what they do, what they charge, and also what alternatives there are to hiring them.

Some Known Questions About Advisor Financial Services.

1. Accounting professional The primary reason most individuals employ an accounting professional is to help them prepare as well as file their tax returns. An accounting professional can help you: Submit your tax return appropriately to prevent an audit, Locate deductions you may be losing out on, such as a office or child care reductionFile an extension on your tax obligations, Spend or contribute to charities in manner ins which will reduce your tax obligations later on If you possess web link a business or are starting a side service, an accountant can do various other jobs for you also.

Your accountant can likewise prepare monetary declarations or records., the ordinary expense to have an try this website accounting professional submit your taxes ranges from $159 for a simple return to $447 for one that includes business income.

Report this wiki page